For ages, it seems, insurance has been a mystery—walk-in, pay your premiums, and file a claim when something goes wrong, praying it works out in your favor. But let’s face it—no one thinks the whole process is outdated, slow, or confusing anymore. Enter AI’s Insurance—a next-gen jump that would take technology and smart algorithms into the fold of coverage and claims. With AI-powered insurance, goodbye clumsy procedures, and hello faster, personalized, and efficient protection.

In this article, we will explore how AI is transforming the insurance sector, what needs it has, and why embracing AI can take your insurance experience to a different level. Let’s get it!

What is AI’s insurance?

AI insurance is pretty much what it says on the tin—an insurance model powered by artificial intelligence. Automation doesn’t scratch the surface—it’s all about data and predictive algorithms along with machine learning to create an insurance policy that is more intelligent and accurate. From customized plans to quicker claims processing, AI does what humans cannot, crunching masses of data at lightning speed and offering an individual solution.

How AI is Revolutionizing Insurance

AI has impelled forces and mores we formerly comprehend possible in the insurance sphere. It is not only helping companies with lower budgets but also improving customer experience in ways we’ve never imagined. Here are a few key points where AI has made a real change.

1. Personalized Insurance Plans

Among the most exhilarating capabilities of artificial intelligence in insurance is the possible ability to provide totally individualized insurance policies; this has changed from giving a universal plan to making an assessment of one’s gathered data like lifestyle, driving habits, health metrics, and much more into a policy tailored just for you. Imagine an insurance policy that modifies or fluctuates regarding your driving behavior, your exercise routine, or perhaps even power efficiency at home. The AI will constantly keep on updating your plan, ensuring that it is perhaps the most efficient and least expensive.

An example of these AI-enabled platforms is one where countless analyses have been done to create insurance products for the users. So, if you needed something about home insurance, health insurance, auto insurance, or life insurance, you would just register on the platform and find the best possible insurance for yourself at the most competitive price using machine learning. AI helps find patterns in behavior that no human agent could pick up from mere interaction, so that way, you’ll never have to pay for coverage you never needed.

2. Faster Claims Processing

However, the whole process seems to be an ages-long pain when it comes to insurance claim filing. Apply for the claim, wait for an adjuster to look into the damages, and, fingers crossed, it all goes well. AI changes all that. Insurance companies powered by AI rely on complex algorithms and image recognition software to assess claims while a customer is reporting. Hence, no more weeks of waiting to find out if your claim will be approved or not.

If you have an auto damage claim and if an AI system were to receive it, it would have scanned pictures of the damage and compared them to thousands of similar incidences and would then have made an instant judgment on the legitimacy of your claim. Less fraud, greater velocity: this system fast-tracks the entire process. AI streamlines the claims process so that it is transparent and more efficient than traditional methods.

3. Predictive Risk Assessment

Insurance has always been that way; risk management has traditionally been viewed through all-encompassing generalized statistics. It, however, becomes more than just a theory when reality manifests in a future occurrence prediction based on an individual’s specific data.

With this, it becomes easier for insurance companies to determine premiums and even the costs of coverage. For example, through weather data, location-based factors, and the condition of property itself, AI can predict the chances that a home will be damaged during a natural disaster. If you’re in a kind of flood-prone area, the AI might give you an additional coverage option for floods or offer you a much more competitive premium based on your unique risk profile. Now, that gives a highly accurate and tailored insurance experience.

4. Customer Service Bots

Insurance companies have always been a little testing. You find long hold-ups, policy lingo, and tons of paperwork nagging you to throw your phone out of the window sometimes; however, there is a hope. AI technology is coming to the rescue. Instead, several insurance firms have created virtual assistants that can respond to their customers’ inquiries using AI chatbots.

These apologetic bots boast 24/7 availability in answering different questions, providing information about policies, and sometimes helping to file claims as well. They not only eliminate the waiting line but also personalize service and enhance reduction in the human factor error. In a matter of seconds, these customer service machines provide a solution to your questions, give quotes, and go a step further to manage your policies for you.

5. Fraud Detection

Fraud continues to be a problem in the insurance sector and costs such billions of dollars every year. However, with the help of AI, insurance firms now have an effective means to detect fraudulent practices. By analyzing the patterns in claims data, AI effortlessly identifies atypical claims that deviate from the norm. This not only saves money for insurance companies but also lowers the premium costs for honest customers.

The AI algorithms detect inconsistency in data, and as soon as it gets identified, they further move toward checking the companies for looking into it. This also cuts the investigation costs, so overall, fraud reduces and premiums go down for everyone, adding up to the fairness in the system.

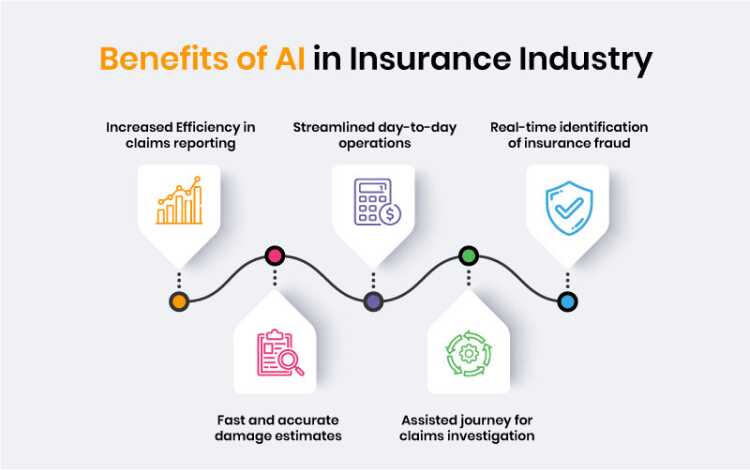

The Benefits of AI in Insurance

Thus stated, the merit of insurance by AI is very apparent. In fact, AI will carve a path into one’s life: from quick processing to adaptive coverage, it shapes the future form, as it seems, of protection. Well, let us examine some of the prominent benefits:

1. Efficiency and Speed

AI processes information at such lightning speed that everything—from policy creation to claim resolution—is accomplished in record time. No more weeks of waiting for a claim to be processed or hours on the phone with customer service.

2. Lower Costs

The insurance companies can save costs by using AI for risk assessment, personalized plans, and fraud detection, consequently offering lower premium rates to the customers. With automation enabled by AI for most components of insurance, operating completely overhead becomes easy, and hence more affordable coverage can be provided.

3. Better Customer Experience

AI doesn’t pay only attention to a processed claim; it is also able to be converted to human behavior. It may be a 24/7 event notification; policy differences that come immediately in the attached campaign become simpler than before, more intuitive for the users.

4. Smarter Risk Management

Predictive capabilities of AI will empower insurance companies for better risk management solutions. Not just the providers calculate the premiums, but it also helps individuals decide wisely about their coverage. It ranges from assessment of health risks to home damage risks to get you the most accurate policy available.

Is AI Insurance the Future?

Sure enough. It takes personal coverage, streamlining claims, and forecasting the future risk to completely revolutionize the insurance industry. Whether you are getting better rates as an individual or optimizing your offerings as a company, insurance will definitely be the future of AI.

Ready to Experience AI-Powered Insurance?

Whether you’ve been bogged down by the cumbersome process of traditional insurance or find the products lacking in personal coverage, the future of insurance is even smarter, as AI is transforming the protection paradigm into something else.

If you want to taste AI-driven insurance—a thing that can help improve your life—it’s really time to start exploring Future Forge. The cutting-edge platform will ensure that the latest innovations in AI get into your insurance experience. It is designed to take care of your need for what type of coverage and its affordability.

Discover Future Forge today to step into the future of protection—yours is only a few clicks away from smarter, faster, and more economical insurance options.